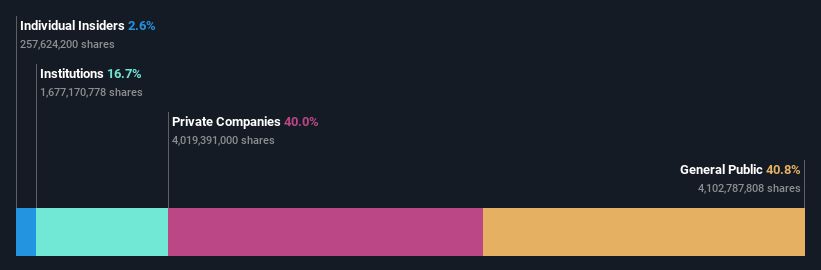

To get a feeling of who is truly in command of Geely Auto Holdings Constrained (HKG:175), it is vital to comprehend the ownership framework of the organization. We can see that specific investors individual the lion’s share in the business with 41{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} possession. In other terms, the team stands to achieve the most (or eliminate the most) from their investment decision into the company.

Evidently, particular person investors benefitted the most right after the firm’s industry cap rose by HK$9.7b previous 7 days.

In the chart under, we zoom in on the different possession groups of Geely Automobile Holdings.

Watch our most up-to-date evaluation for Geely Automobile Holdings

What Does The Institutional Ownership Convey to Us About Geely Auto Holdings?

A lot of institutions measure their performance towards an index that approximates the local current market. So they usually pay back more interest to companies that are included in big indices.

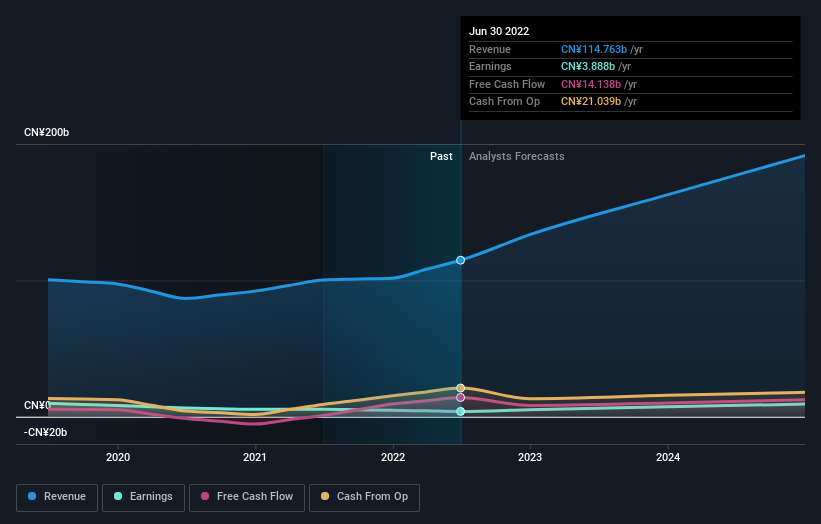

Geely Automobile Holdings presently has institutions on the share registry. Without a doubt, they personal a respectable stake in the firm. This indicates some reliability amongst professional traders. But we can’t count on that fact alone given that institutions make negative investments occasionally, just like all people does. It is not unheard of to see a big share selling price fall if two huge institutional traders test to offer out of a inventory at the exact same time. So it is really worth examining the past earnings trajectory of Geely Automobile Holdings, (down below). Of class, hold in intellect that there are other factors to take into account, much too.

We notice that hedge cash do not have a meaningful expenditure in Geely Auto Holdings. The company’s biggest shareholder is Zhejiang Geely Keeping Group Co., Ltd., with ownership of 40{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}. For context, the next biggest shareholder retains about 2.2{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of the shares remarkable, adopted by an possession of 2.1{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} by the 3rd-largest shareholder. Shu Fu Li, who is the next-most significant shareholder, also occurs to keep the title of Major Crucial Executive.

Our scientific tests propose that the best 25 shareholders collectively manage fewer than fifty percent of the company’s shares, which means that the company’s shares are greatly disseminated and there is no dominant shareholder.

Although finding out institutional ownership for a company can insert benefit to your analysis, it is also a superior apply to study analyst suggestions to get a further have an understanding of of a stock’s envisioned functionality. There are a fair number of analysts covering the inventory, so it may possibly be valuable to uncover out their mixture look at on the long term.

Insider Possession Of Geely Automobile Holdings

The definition of company insiders can be subjective and does vary concerning jurisdictions. Our info reflects unique insiders, capturing board users at the extremely least. The corporation administration solution to the board and the latter should really depict the pursuits of shareholders. Notably, in some cases major-degree managers are on the board them selves.

Insider possession is good when it indicators leadership are considering like the true house owners of the organization. Even so, substantial insider possession can also give enormous energy to a tiny team in the organization. This can be damaging in some conditions.

Shareholders would most likely be interested to learn that insiders personal shares in Geely Car Holdings Restricted. It is a extremely big enterprise, and board customers collectively very own HK$3.2b well worth of shares (at present selling prices). we from time to time choose an desire in whether they have been shopping for or marketing.

Basic General public Possession

The basic public, who are ordinarily individual investors, maintain a 41{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} stake in Geely Automobile Holdings. Though this team are unable to always contact the shots, it can absolutely have a actual impact on how the company is run.

Non-public Enterprise Possession

We can see that Personal Companies possess 40{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}, of the shares on issue. It could possibly be truly worth seeking further into this. If similar functions, these types of as insiders, have an desire in one of these personal firms, that must be disclosed in the yearly report. Private businesses might also have a strategic interest in the company.

Subsequent Actions:

Even though it is properly really worth thinking about the distinct groups that very own a company, there are other variables that are even a lot more important. To that end, you really should be aware of the 2 warning indications we have noticed with Geely Car Holdings .

If you would like find what analysts are predicting in conditions of potential progress, do not overlook this free report on analyst forecasts.

NB: Figures in this posting are calculated making use of facts from the final twelve months, which refer to the 12-month period of time ending on the previous date of the month the fiscal statement is dated. This may possibly not be regular with entire 12 months yearly report figures.

Valuation is intricate, but we’re serving to make it simple.

Obtain out regardless of whether Geely Auto Holdings is possibly in excess of or undervalued by examining out our complete investigation, which involves reasonable worth estimates, risks and warnings, dividends, insider transactions and money overall health.

Check out the Absolutely free Investigation

Have opinions on this report? Worried about the articles? Get in touch with us directly. Alternatively, e mail editorial-crew (at) simplywallst.com.

This report by Only Wall St is standard in nature. We give commentary based on historical knowledge and analyst forecasts only employing an unbiased methodology and our article content are not intended to be financial assistance. It does not represent a advice to purchase or promote any stock, and does not consider account of your objectives, or your money circumstance. We aim to bring you lengthy-time period focused investigation pushed by essential knowledge. Notice that our assessment may not variable in the latest price-sensitive enterprise bulletins or qualitative materials. Basically Wall St has no situation in any stocks talked about.

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand