Germany has produced some of the very best-acknowledged cars in the world. Their brands are dependable, trendy, and of the most effective high quality. Above the several years now the car industry has attracted a whole lot of buyers. Having said that, the landscape is shifting with the adoption of electrical vehicles (EV) and hybrid products in the industry. The huge gamers are now all competing to dominate the EV house.

The international current market for EVs is however underdeveloped, leaving huge scope for brands to mark their territory.

Contemplating this backdrop, we have used the TipRanks Inventory Screener device for the German industry to choose a few vehicle giants, Volkswagen (DE:VOW3), Mercedes-Benz Team (DE:MBG), and Bayerische Motoren Werke Aktiengesellschaft (DE:BMW). This software contains all the stocks from distinctive marketplaces and can be screened on the foundation of distinct parameters.

Let us get a glance at these providers in detail.

Volkswagen

The Volkswagen Team has some top rated-class manufacturers like Volkswagen, Skoda, Audi, Bentley, Ducati, Lamborghini, and numerous extra under their umbrella.

The stock has been on a downward journey since the world-wide COVID-19 pandemic and the lockdowns. After a slight restoration, the stock received some momentum just after the organization introduced increasing its manufacturing and current market share for electrical vehicles (EV). Due to the fact then, it has been a shaky ride for the inventory, which has fallen by 19{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the past calendar year.

The firm is aggressively pursuing its intention of transitioning to electric motor vehicles. It even introduced options to shift wholly to an EV portfolio in Europe in 2033. The firm is, on the other hand, facing source disruptions since the outbreak of the war in Ukraine, which is influencing creation targets.

The enterprise even now managed a 25{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} enhance in the supply of all-electrical automobiles, as noted in its interim report for 2022. The management remains confident in the company’s means to withstand macroeconomic problems and verify its resilience all over again.

Volkswagen Stock Forecast

TipRanks premiums Volkswagen inventory as a Moderate Invest in, with 6 Acquire, four Keep, and a person Offer recommendation.

The average VOW3 target rate is €186.6, with an upside opportunity of 35.4{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}.

Bayerische Motoren Werke Aktiengesellschaft (BMW)

German-dependent BMW is among the leading manufacturers of luxurious and high quality vehicles in the world. Its brands include things like BMW, Rolls-Royce, MINI, and BMW Motorrad.

Staying a premium auto maker, BMW caters to the affluent class and is significantly less afflicted by the recessionary pressures in the financial system. This was really visible in its stock charges, which were performing reasonably far better than people of its opponents. The inventory has been trading up by 3{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the final yr and by 30{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the final 3 a long time.

Moving on to the EV battle, BMW is also at the forefront to seize a better sector share. Despite the troublesome environment for the EV players, the organization managed to double its EV income in the initial half of 2022, with a full of 75,891 models sold across the environment.

Will BMW Stock go up?

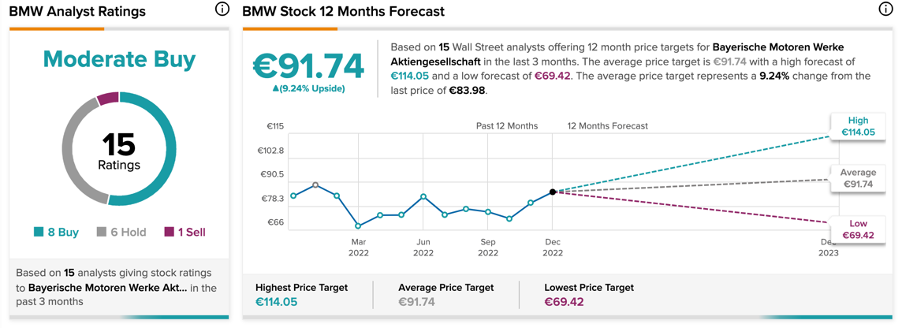

In accordance to TipRanks’ rating consensus, BMW stock has a Average Acquire rating.

The BMW concentrate on value is €91.7, which is 9.2{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} higher than the recent cost degree. The goal value ranges from a very low of €69.42 to a high of €114.05.

Mercedes-Benz Group

A different participant in the German sector is the Mercedes-Benz group, acknowledged for its luxury vehicles and industrial automobiles all over the world.

The firm painted an outstanding image with its third-quarter figures in 2022. The profits jumped to €37.7 billion, up by 19{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} from the 3rd quarter of 2021. Earnings prior to taxes elevated by a massive 83{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} to €5.2 billion. The results plainly depict a enormous need for the company’s products and solutions, such as the quality and EV products. The company’s passenger motor vehicle BEV (battery electric powered cars) revenue observed a whopping bounce of 183{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the 3rd quarter.

Mercedes has also declared its shift to all-electrical by 2030 as element of its aim toward an emission-no cost future. It is investing €40 billion underneath this plan to ramp up its generation network, among the other matters.

Is Mercedes Inventory a Buy?

As for every the TipRanks databases, the Mercedes stock has a Robust Get score with 15 Get recommendations.

The analysts hope a 24{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} hike in the share price ranges, with an common value target of €80.14. The significant and lower forecasts for the selling price are €99.1 and €64.4, respectively.

Summary

The vehicle market is at this time dealing with selected headwinds with offer and logistics challenge impacting their EV productions and profitability in the short phrase. Even so, the figures are predicted to more strengthen for the fourth quarter of 2022.

These three giants, with their fascinating product or service lines and an eye toward a more substantial EV sector share, make their stocks very eye-catching.

Disclosure

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand