Commonly talking the aim of active inventory choosing is to find corporations that offer returns that are excellent to the market normal. Getting below-rated businesses is a single route to extra returns. For case in point, the Guangzhou Car Team Co., Ltd. (HKG:2238) share cost is up 14{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the final 5 years, plainly besting the current market return of around 7.5{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} (ignoring dividends).

So let us evaluate the fundamental fundamentals about the last 5 years and see if they have moved in lock-stage with shareholder returns.

Check out our most recent evaluation for Guangzhou Car Team

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not often rationally replicate the benefit of a enterprise. 1 imperfect but basic way to take into consideration how the market notion of a business has shifted is to review the alter in the earnings per share (EPS) with the share cost motion.

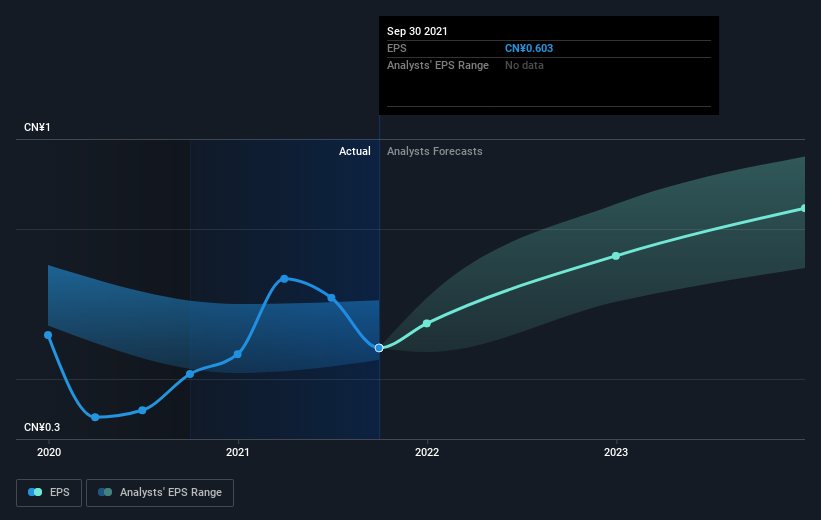

All through five several years of share price expansion, Guangzhou Auto Team attained compound earnings for every share (EPS) progress of 1.2{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} for each year. This EPS advancement is slower than the share value progress of 3{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} for every 12 months, in excess of the exact same time period. So it is really good to presume the industry has a increased opinion of the business than it did five yrs back. And that is rarely shocking supplied the monitor document of advancement.

You can see below how EPS has improved in excess of time (explore the exact values by clicking on the impression).

It can be likely well worth noting that the CEO is paid considerably less than the median at identical sized corporations. It really is normally value preserving an eye on CEO pay back, but a additional important problem is no matter if the corporation will develop earnings all through the many years. This totally free interactive report on Guangzhou Car Group’s earnings, income and money stream is a great area to start out, if you want to investigate the inventory additional.

What About Dividends?

When searching at financial commitment returns, it is vital to look at the difference in between total shareholder return (TSR) and share price tag return. The TSR incorporates the worth of any spin-offs or discounted money raisings, along with any dividends, based on the assumption that the dividends are reinvested. It is reasonable to say that the TSR offers a much more complete picture for shares that pay a dividend. In the scenario of Guangzhou Automobile Group, it has a TSR of 38{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} for the last 5 a long time. That exceeds its share price tag return that we beforehand talked about. This is mainly a result of its dividend payments!

A Various Point of view

Even though the broader market dropped about 6.{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in the twelve months, Guangzhou Auto Group shareholders did even even worse, getting rid of 8.{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} (even such as dividends). On the other hand, it could basically be that the share cost has been impacted by broader industry jitters. It might be well worth trying to keep an eye on the fundamentals, in circumstance there’s a excellent possibility. For a longer period expression investors would not be so upset, because they would have designed 7{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}, every single 12 months, about 5 many years. If the elementary details carries on to point out prolonged time period sustainable progress, the present-day offer-off could be an option value contemplating. It can be constantly intriguing to monitor share price functionality above the lengthier expression. But to fully grasp Guangzhou Auto Team improved, we need to take into account a lot of other aspects. To that conclude, you need to be aware of the 2 warning signs we’ve noticed with Guangzhou Auto Group .

For all those who like to locate winning investments this totally free listing of escalating firms with modern insider purchasing, could be just the ticket.

Be sure to note, the industry returns quoted in this report replicate the market weighted regular returns of shares that currently trade on HK exchanges.

Have suggestions on this short article? Worried about the articles? Get in touch with us specifically. Alternatively, e mail editorial-staff (at) simplywallst.com.

This post by Just Wall St is basic in mother nature. We offer commentary dependent on historic facts and analyst forecasts only making use of an impartial methodology and our content are not supposed to be money guidance. It does not constitute a recommendation to invest in or sell any inventory, and does not just take account of your targets, or your economic circumstance. We intention to provide you extensive-phrase targeted assessment driven by essential knowledge. Note that our examination may possibly not factor in the most recent rate-delicate firm announcements or qualitative materials. Merely Wall St has no posture in any shares described.

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand