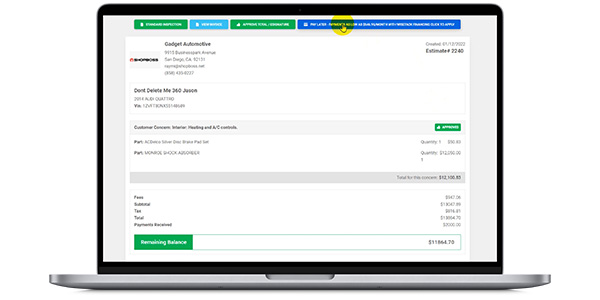

Your consumer clicks on the url your service advisor just texted. The updated restore purchase at the conclusion of the connection confirms her worst dread: Your technician’s repair tips value much more than what is in her financial institution account and all but eliminates whatever’s still left on her substantial-equilibrium credit rating card. That is when she places a button in the upper-ideal corner of the mend purchase that reads: “Pay Later on: Payments as Small as $XX.XX / Month with Shopper Funding. Click to Use.”

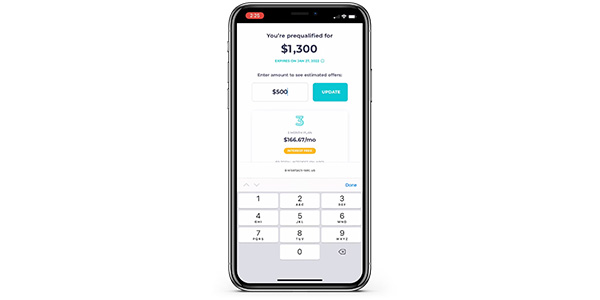

The button normally takes the consumer to a purchaser finance portal, exactly where she begins a brief prequalification process built to match her with the correct offer from a person of 4 finance resources readily available in this digital hub. Again at the store, your provider author is preparing to send his 3rd fix purchase update with that similar financing button when the warn comes: The buyer qualifies for an amount that handles the cost of the encouraged repairs.

Missing from that state of affairs are the payment schedules and compliance disclosures that never ever created repair service funding value the hassle. This illustration also has repair service funding offered the way it should have been all alongside, and which is as a payment possibility and not a solution your young counter person was never heading to be ready to promote in the to start with place. More importantly, that state of affairs sites Restore-Now, Pay back-Later on financing in which it’s never ever been in advance of: at the issue of decision.

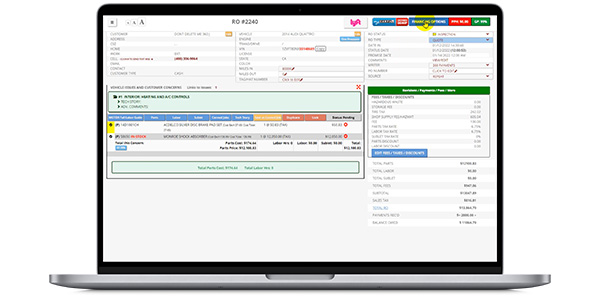

Which is the promise of the landmark partnership introduced in March amongst 360 Payment and Shop Manager, which turned the initial store management program to plug into 360 Payments’ new Customer Finance Portal. Dubbed 360 CFP, it provides the mend industry the identical procuring cart encounter that manufactured Buy-Listed here, Shell out-Now financing the swiftest-rising payment process in 2021 and aided stores capture $97 billion of the $4.6 trillion in world wide e-commerce transactions in 2020.

And it is a shopping cart practical experience that began to get shape by way of COVID-19 when fix shops had been pressured to turn to electronic vehicle inspections and Textual content-to-Pay out answers like Manager Spend to limit speak to with pandemic-weary customers. And it is 1 your prospects however want nowadays.

Because 2018, Boss fork out transactions have developed from about $280,000 to much more than $27 million in 2021. Which is much more than a 9,600{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} increase in just a few a long time. Also, take into consideration that Manager Pay back had now processed additional than $10 million Textual content-to-Spend transactions by the next complete week of April.

“We’re at the intersection of two significant trends: The realization by shoppers that today there are far better selections for how they can borrow, and the adoption of get-now, shell out-later on in e-commerce … exhibiting how big the require is by shoppers,” Wisetack CEO Bobby Tzekin instructed PYMNTS.com in December, just before the BNPL provider introduced it would be one of the initially finance sources to make itself out there to restore outlets by 360 CFP.

Here’s why: According to facts produced in May perhaps 2019 by the Federal Reserve, nearly 40{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of Us residents could not include a shock $400 cost. Furthermore, benefits from a July 2020 LendingTree study disclosed that practically six in 10 of the 1,071 car or truck entrepreneurs polled skipped a essential vehicle restore because they couldn’t pay for it, 71{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of whom had been millennials.

Millennials, by the way, account for the major part of BNPL end users, according to PYMNTS.com. These individuals, ages 26 to 41, lived via the Terrific Recession and uncovered the really hard classes of superior credit card balances, producing them prime candidates for 360 CFP.

Also, consider that inflation grew speedier in 2021 than in the previous 40 decades. The result is shoppers who used $100 a thirty day period on gasoline in 2020 compensated $150 in 2021. That’s one particular of the good reasons credit score card balances, in accordance to the Federal Reserve Bank of New York, rose by $17 billion in the two the 2nd and third quarters of previous calendar year.

But if there is a single issue we acquired by way of current economic worries, it’s that Americans value personal transportation. Really serious auto delinquency rates, which achieved their greatest degrees due to the fact 2012 in the lead up to the pandemic, remained around or under pre-pandemic levels in 2021. Also hold in head that for the duration of the Great Recession, vehicle loans have been a person of the most effective-accomplishing asset lessons via the Great Economic downturn. Why? Since individuals require their autos.

Shop Boss’ integration with 360 CFP and finance resources like Wisetack signifies your shop now has a way to keep buyers on the highway during attempting occasions and a alternative for closing far more suggested repairs throughout good situations. Welcome to the New Standard.

If you are fascinated in learning additional about the seamlessly integrated purchaser financing option for your shop, click listed here.

Shop Manager is the main automotive repair application for impartial car retailers and is made for optimum effectiveness and profitability. Established by a previous store owner, Shop Boss makes it possible for users to competently handle shop functions from everywhere by way of an intuitive cloud-primarily based interface. With an array of reducing-edge functions and integrations, Store Manager allows outlets of all dimensions go paperless and supply a safe and sound-length auto fix experience.

To study additional, take a look at ShopBoss.internet. To learn much more about Shop Boss’ integration with 360 Payments’ new Consumer Finance Portal, click right here.

More Stories

Essential Auto Repair Services Every Car Owner Should Know

Missouri couple left waiting days to get car back from mechanic

Diagnostic Network Launches New Module Swap System to Enhance Reprogramming Knowledge Among Members