Petmal/iStock by way of Getty Pictures

Article Content material

Progress investments, which include most EV picks, have gotten pummeled in excess of the past couple of months on the back again of fascination price worries. With valuations obtaining declined considerably, a closer glimpse at some of the more compact EV gamers helps make feeling. In this article, we’ll pit Canoo Inc. (GOEV) and Workhorse Team Inc. (WKHS) in opposition to each other to see which a person is a lot more beautiful at current charges.

How Is Canoo Various From Workhorse?

The EV marketplace has noticed a wide range of market place entrants in the latest several years, which consists of legacy gamers that started out to introduce EV products, but which also features numerous startups that are EV pureplays. Both Workhorse and Canoo belong to the group of EV pureplays.

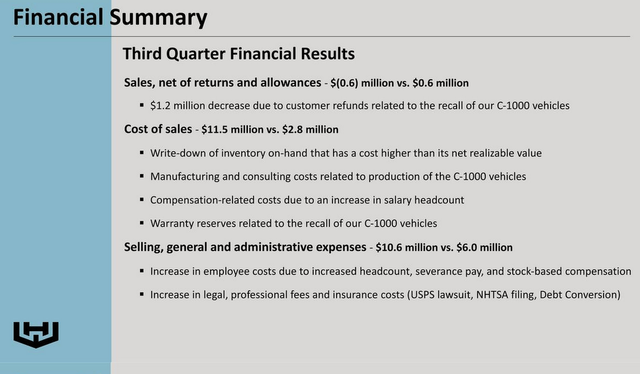

Workhorse is a company concentrated on medium-responsibility commercial motor vehicles that are battery-run. Workhorse also features expert services to its buyers that are working commercial automobile fleets, these kinds of as telematics monitoring. Throughout its 3rd quarter, Workhorse produced the following final results:

Workhorse final results Q3

Workhorse presentation

Gross sales in fact were being unfavorable all through the quarter, while that was due to a one-time issue. Workhorse experienced to refund clients for defective C-1000 autos. In past quarters, WKHS did not make in particular significant revenue, possibly, however. Throughout the second quarter, for case in point, Workhorse created profits of $1.2 million, which isn’t nearly sufficient to address the company’s costs. During the third quarter, Workhorse reported complete bills of all over $25 million, just before fascination expenses and other losses, these kinds of as the decline on the sale of its LMC investment. Workhorse operates with a latest income burn off charge of about $15 million for every thirty day period, which is very meaningful for a enterprise with a current market capitalization that does not have extremely substantial economical resources. Workhorse is presently developing two models of its C-collection truck per week, which helps make for yearly output numbers of close to 100 motor vehicles. Clearly, at least for now, Workhorse is not in a situation in which generation and gross sales are any where shut to levels the place they are economically viable in the long operate. Workhorse is confident that it will control to transform the firm’s functions close to and that it will be a foremost business in the transition of professional automobile fleets in direction of becoming energy-driven.

The industry prospect for Workhorse is terrific, of study course. There are quite a few thousands and thousands of business cars on the road right now, and that number will only increase going forward. Developments such as developing e-commerce income, that need shipping automobiles, or growing intake in substantial-advancement nations these types of as India or China will outcome in far more and more industrial cars being employed all-around the globe. At the identical time, due to firms staying interested in lowering their emissions, and because of to governments/authorities demanding lower emissions to overcome world wide warming and air air pollution, a rising range of these professional cars will be run by electricity. A lot of industry prospective by yourself will not make WKHS a wonderful expenditure, however, as it is not confirmed that WKHS will be amongst the upcoming leaders in this significant-development and significant-value market.

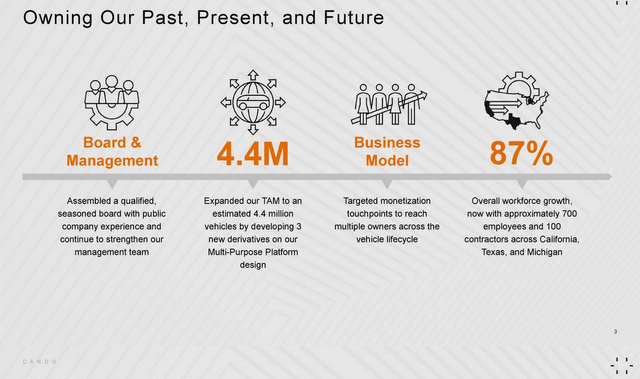

Canoo is a diversified electric powered mobility enterprise that is active in professional and consumer markets. Like Workhorse, it seeks to develop into a big player in the emerging, substantial-worth electric professional auto current market. Contrary to Workhorse, Canoo is nevertheless in a pre-earnings stage, as it has not marketed any automobiles nonetheless. The firm has a credible approach of bringing its first EVs to the current market in the foreseeable long run, nonetheless. Canoo is, contrary to Workhorse, not solely centered on professional cars. As a substitute, the enterprise ideas to use its architecture for a vary of automobiles in order to expand the overall addressable sector:

Canoo outlook

Canoo presentation

For every administration, the overall addressable market is north of four million vehicles by now, despite the fact that that by yourself does not make Canoo a obtain, just like with WKHS. For now, the enterprise appears to be to be on monitor to provide vehicles in the foreseeable foreseeable future, but commercial results is considerably from guaranteed.

Is Canoo Larger sized Than Workhorse?

The answer to this query is dependent on how you define dimension. On a revenue and product sales foundation, Workhorse is the bigger amid these two, despite the fact that even WKHS is quite compact in terms of the number of motor vehicles it has shipped so much and will be delivering this year.

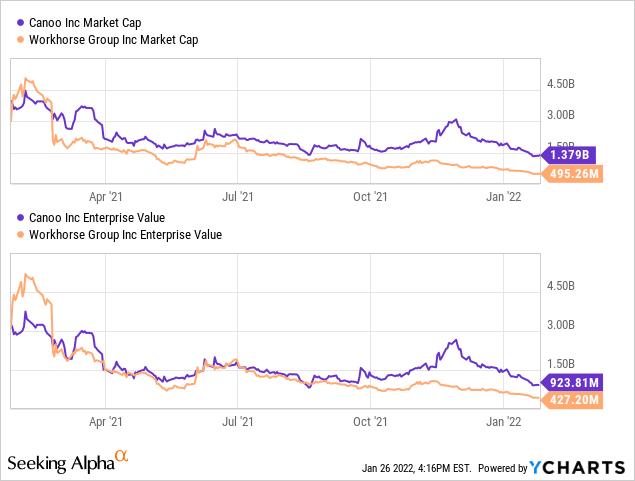

In terms of sector capitalization, Canoo is the more substantial organization by far:

Canoo’s marketplace capitalization is all-around 3x as superior as that of Workhorse, while Canoo’s business price is roughly 2x as higher as that of Workhorse. GOEV has considerably more substantial cash reserves (on a web foundation), at about $460 million, compared to $70 million at WKHS. This explains why there is a much larger big difference involving market place capitalization and organization value at Canoo. At the identical time, the much larger money reserves make Canoo the much less risky decide on, I imagine, as Canoo has bigger assets that can be utilized for ramping up generation in the foreseeable future — despite the fact that it is unlikely that the ~$.5 billion of cash will be more than enough to convey the enterprise to a sizing in which it can self-fund all future development. Workhorse, with its lessen money assets, is even significantly less probable to get to a size where it can self-fund long term growth before acquiring to increase new revenue by way of debt or a secondary providing.

Who Are GOEV And WKHS’ Opponents?

Seeking at brands of electrical business autos only, there are however a number of strong competitors worthy of noting. Rivian (RIVN), for instance, has a deal with Amazon (AMZN) to order 100,000 electric powered delivery vehicles, earning it rather a great deal a certain bet that Amazon by itself will purchase commercial vehicles well worth billions of dollars from Rivian. This is a quite potent endorsement for Rivian’s product, and coupled with billions of dollars in funds that Rivian has on its equilibrium sheet, it seems like a leading competitor for Canoo and Workhorse.

Amazon has also purchased electrical cars from other providers, on the other hand. This contains legacy gamers these kinds of as Stellantis (STLA) and Daimler (OTCPK:DMLRY), which naturally have huge methods, earning them viable rivals in this place as perfectly. On best of that, there are other EV pureplays with business automobiles on the market place or in the works, these as Berkshire Hathaway-backed BYD (OTCPK:BYDDY). With in-house battery progress and generation, and sizeable working experience in ramping up the generation of EVs, BYD is, I believe, an essential and able competitor as perfectly. EV king Tesla (NASDAQ:TSLA) also seeks to turn into a participant in the business vehicles market with its Tesla Semi, despite the fact that that is not a shipping and delivery auto mostly.

In small, there is a extensive assortment of opponents, many of people currently being hugely able, knowledgeable manufacturers with large methods (staff and monetary). This has to be predicted in a large-worth sector with lots of expansion prospective, although.

Is GOEV Or WKHS The Better Purchase?

Each organizations are looking for to make a splash in the large and developing business automobiles market, but I do believe that that their outlook differs. Neither enterprise is successful (in simple fact, quite considerably from it), but Canoo obviously is the corporation with much better assets. Canoo’s income position, per its most new 10-Q submitting, is additional than $400 million, and the organization will advantage from fiscal incentives for constructing out its property in Oklahoma and Arkansas. Workhorse, by comparison, has a minor more than $230 million of hard cash on its harmony sheet today, which will make it more difficult for the enterprise to spend in its expansion likely ahead. On best of that, executing a secondary supplying is not a wonderful alternative for Workhorse, thanks to the company’s low marketplace capitalization. Even increasing just yet another $200 million would dilute latest shareholders by around 50{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}, whilst Canoo, with its bigger current market cap, could increase further funds extra effortlessly.

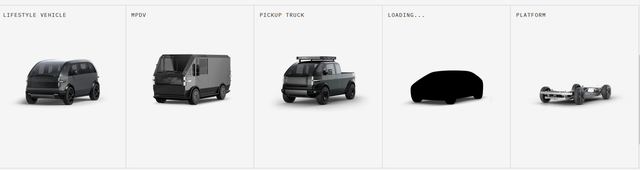

Canoo’s system that lets for a assortment of autos currently being made at the similar time, such as shopper automobiles and professional cars, has pros:

Canoo vehicles

Canoo web site

With a greater addressable marketplace, Canoo could be in a position to generate higher profits as opposed to Workhorse, which has a much more narrow aim. On leading of that, establishing 1 system and applying it for extra than 1 car or truck will allow for some price synergies, as R&D charges are dispersed about a number of products and solutions, which could outcome in much more beautiful margins after operations are scaled up.

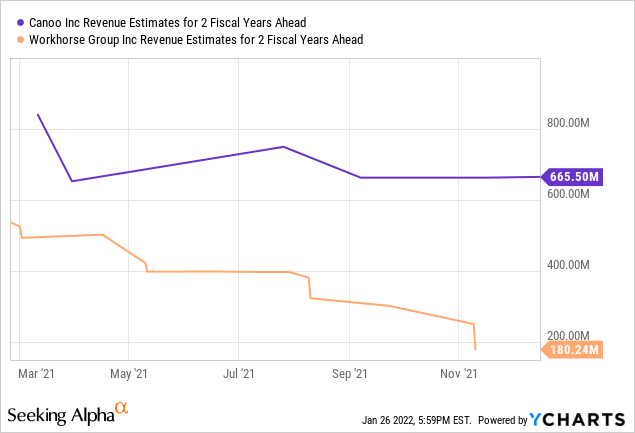

Canoo is, many thanks to its greater funding and more substantial item portfolio, forecasted to create appreciably better income in comparison to Workhorse:

In truth, WKHS’s income estimate has declined fast over the last 50 {7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}-yr or so, as operational troubles, such as the C-1000 recall, bought factored into analyst styles.

Investing in a startup that is at a pre-earnings stage is constantly dangerous, but it appears like dangers are greater at Workhorse in contrast to Canoo, even though Canoo is just not a reduced-hazard pick, both. Due to a more eye-catching merchandise portfolio, much better liquidity, and much better execution (no untimely deliveries of faulty motor vehicles), Canoo appears like the superior decide to me. I do not believe that it is essentially a purchase, nevertheless. The industrial motor vehicles marketplace will continue being very aggressive, and it is far from confirmed that a new market entrant will be productive, in particular since competitors this sort of as Rivian, Daimler, and many others. have large means in comparison to Canoo.

From a timing point of view, it also looks that buyers could be better off not moving into a situation in both Canoo or Workhorse currently. The two corporations have witnessed their shares drop in recent weeks owing to curiosity rate concerns and a standard bear marketplace in “speculative advancement” stocks. It is definitively probable that this marketing strain persists, which is why being on the sidelines could be a intelligent notion until traders have a clearer photograph of the creation ramp and doable demands for additional capital raises.

All in all, I might so say that Canoo is the better decide on between these two organizations, but that does not signify that purchasing Canoo these days have to be the ideal choice. Rather, retain an eye on Canoo, but hold out for the present-day sector turmoil to shake out and hold out till we get a clearer picture about the output ramp could be an recommended system.

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand