Jae Young Ju/iStock via Getty Images

For more than a year, the media was jam-packed with news about a “semiconductor shortage.” The primary explanation for the shortage was a miscalculation by chipmakers that the COVID-19 pandemic that was raging in 2020 would not cause demand for chips that sprung up as a result of work/study/stay-at-home edicts. These resulted in increased demand for PCs, remote video conferencing, game stations, and server bandwidth, which created demand for semiconductors for applications in the absence of automotive demand. Then a few months later automotive demand resurfaced, impacting chip manufacturers.

While there have been irregularities in semiconductor production associated with COVID and shutdowns, which I discuss in a section below, much of the blame on poor U.S. auto sales has been attributed to the “semiconductor shortage.”

Impact of “Semiconductor Shortage”

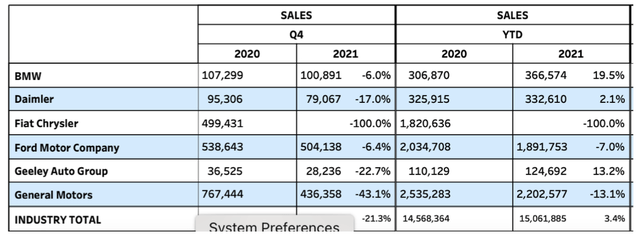

Ford (F) shipped 1,891,753 vehicles in the U.S. in 2021, down 7{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} from 2,034,708 in 2020, as shown in Table 1. The company’s shipment performance was among the worst of the manufacturers.

General Motors (GM) decreased 13{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}. That drop was deceiving, however because GM recalled over 140,000 Bolts for battery fire risk in August 2021 and kept its Orion Assembly production plant closed since then. As a result, in 4Q2021, GM sold 437,358 vehicles in the U.S., down 43{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} from the same period last year. Of those 437,358 vehicles, only 26 were EVs.

For 2021, U.S. shipments increased just 3.4{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} YoY to 15.1 million units from 14.6 million in 2020. Sales in 2020 were also lower than 2019 as YoY shipments dropped 14.4{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} from 17.0 million in 2019.

Cox Automotive

Table 1 – Source: Cox Automotive

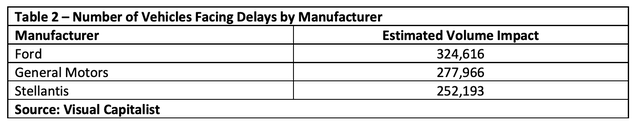

One contributing cause of the drop in shipments has been attributed to the semiconductor shortage as discussed above. Of the more than 1.1 million vehicles estimated to have face production delays, Ford was the most impacted with 324,616 facing delays, as shown in Table 2.

Visual Capitalist

Auto Industry and Consumer Sentiment in the U.S.

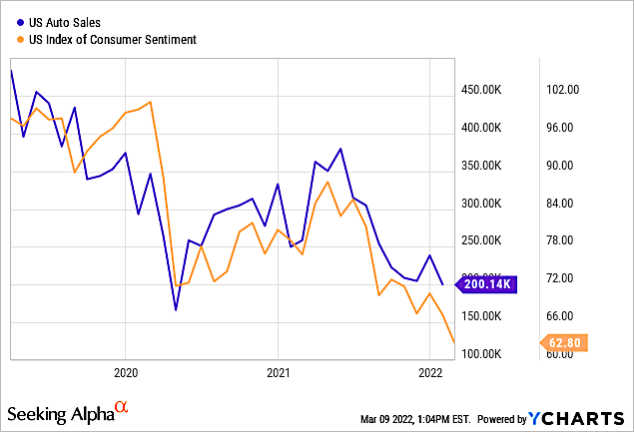

However, data indicate that his is not the case, but is directly related to U.S. consumer sentiment, as shown in Chart 1. Consumer Sentiment is an economic indicator that measures how optimistic consumers feel about their finances and the state of the economy. In other words, if people feel rich they will buy items such as automobiles.

Chart 1 shows that Consumer Sentiment dropped precipitously with the start of the COVID pandemic, and then started rising until reaching a peak in April 2021 when it reached a high in April 2021, tied with the euphoria over sanctions being lifted as the pandemic slowed.

Consumer sentiment dropped sharply in early May, as inflation spiked and consumers prepared for higher interest rates.

YCharts

Chart 1

Why Were Predominantly ICE Autos Impacted?

I asked the question in a Sept. 16, 2021, Seeking Alpha article entitled “Tesla Outperforms Competition Despite Covid And The Semiconductor Shortage,” why are predominantly ICE vehicles impacted?

Shipments of xEVs (BEV + PHEV) for 2021 vs. 2020 increased 96{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} in North America compared to the total industry growth of just 3.4{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} for just the U.S. in Table 1 above.

According to our report entitled “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts,” a cost analysis of comparably-priced EVs vs. ICEs shows that, if we include batteries, component costs of an EV are significantly higher for the EV. Otherwise, component costs are comparable.

This raises an important issue. If there’s a shortage of semiconductors for automobiles, and EV automobiles use significantly more semiconductors than ICE automobiles, then why are ICE manufactures shutting down plants and promoting EVs? Clearly the Biden Administration’s green policy, discussed in the Investor Takeaway section, plays a big role.

Semiconductor Industry “Shortages”

I wrote numerous articles in Seeking Alpha, attempting to locate what semiconductors were being shorted, as there are dozens of types, within major categories of chips such as memory, microprocessors, microcontrollers, analog, and discrete.

These articles were done without the cooperation of the automobile manufacturers, because after repeated calls to find out exactly what chips were shorted to pinpoint the type and location, I received no response.

Ultimately, I identified microcontrollers as the major source of the shortage, not necessarily due to chip manufacturers affected by COVID brain fog, but to an earthquake and fire at a semiconductor fab in Japan.

I published my findings in a June 17, 2021 Seeking Alpha article entitled “Microchip Technology: Benefiting From Strong Microcontroller Demand And Shortages.” I refer readers to the article and noted about the shortage:

“Significantly, an earthquake in February 2021 halted the production located in Hitachinaka, Ibaraki Prefecture for a few days, trimming inventory. Then, on March 19, 2021, a fire broke out in the N3 building at Renesas’ (OTCPK:RNECF) Ibaraki-based component fabrication site. The blaze destroyed 23 pieces of semiconductor manufacturing equipment and contaminated over 6,400 square feet of industrial production space. Production recovered to reach 100{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} capacity in mid-June. The Japanese chip-making factory owned by Renesas Electronics Corp., accounts for 30{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of the global market for microcontroller units used in cars.”

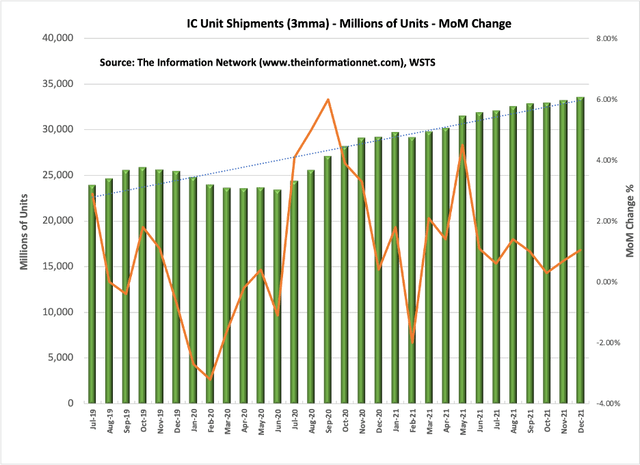

Chart 2 shows unit shipments of all ICs, showing an increase in unit shipments (green bar) that started in July 2020, 18 months ago. The trendline shows the growth. Equally important, MoM changes peaked in July 2021 and have slid since then except for a small uptick in November 2021.

The Information Network

Chart 2

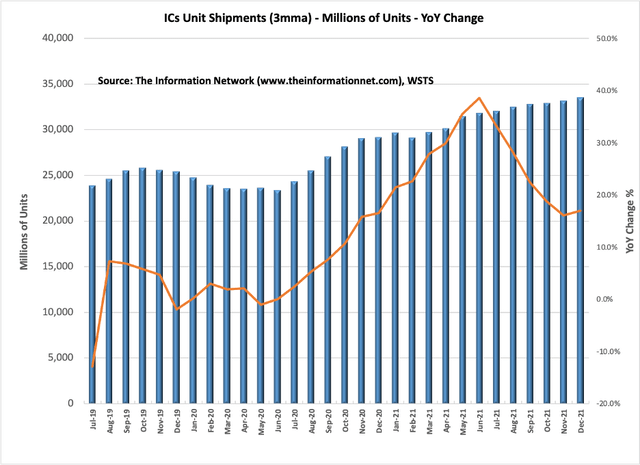

Chart 3 shows the same unit shipments as in Chart 4, but shows YoY changes (orange line) instead of MoM. Here we see that overall, YoY shipment growth reached its peak in June 2021 and has been dropping continuously except for a small uptick in December 2021.

This begs the question, along with MoM data, why haven’t semiconductor manufacturers continued to ramp up production if there was a semiconductor shortage.

The answer is simple. The peak in semiconductor shipments in June 2021 indicates to me that the semiconductor shortage has been over for a minimum of six months.

The Information Network

Chart 3

Investor Takeaway

My contention is that while a “semiconductor shortage” hamstrung automobile manufacturers immediately after the pandemic, this shortage has been over for a minimum of six months. The continued erosion in auto sales is due to eroding consumer sentiment coupled with green policies.

I also contend that talk of the “shortage” continuing are efforts by semiconductor manufacturers to secure government handouts to build fabs in the U.S. and the supply chain, like autos and consumer goods, to get government tax credits and incentives.

Indeed, Ford verified my analyses that “semiconductor shortage” is being used as an excuse by creating two separate business lines, each reporting its own profit and loss, and CEO Jim Farley commenting:

“The reality is our legacy organization has been holding us back. We had to change.”

As a result of the split, according to the article, Ford plans to produce 2 million electric vehicles in 2026, up from 600,000 EVs planned for 2023. Ford anticipates a $3 billion in costs reduction, stemming largely from streamlining the company’s combustion engine car business, centered around high-profile models like the Mustang coupe, Bronco SUV, and F-150 pickup truck.

Ford announced in January 2020 that it is doubling the planned production capacity of its upcoming F-150 Lightning electric pickup and is also tripling output of the Mustang Mach-E compared to last year.

Tough new fuel efficiency standards by the EPA will require automakers to reach a fleet-wide average of about 40 mpg by 2026, which electric vehicles will help achieve.

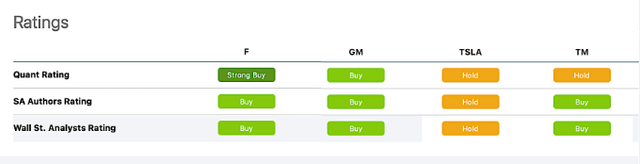

Chart 4 shows that Ford also has higher Seeking Alpha Quant Factor Grades than TSLA, General Motors (GM), Tesla (TSLA), and Toyota (TM).

YCharts

Chart 4

Chart 5 also shows Ford as a strong buy, ahead of GM and the other manufacturers in the chart.

YCharts

Chart 5

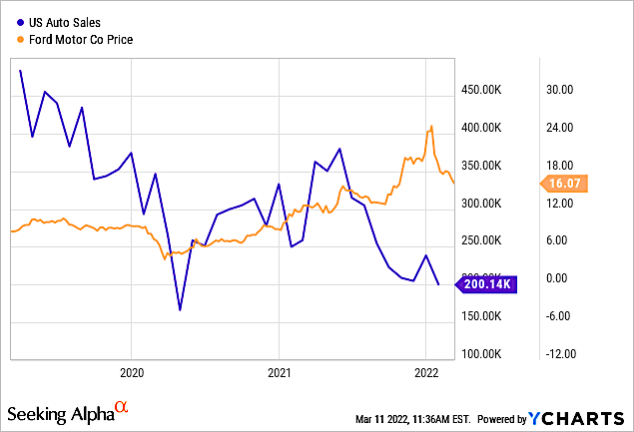

Chart 6 shows Ford’s stock performance compared to U.S. Auto Sales (which was compared to Consumer Sentiment in Chart 1).

YCharts

Chart 6

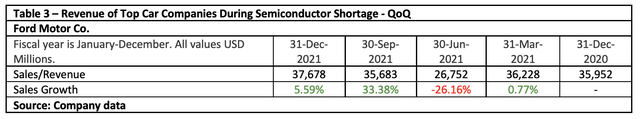

Although Ford was impacted by the “semiconductor shortage” it’s apparent that financial metrics, particularly in the past two quarters, has overcome headwinds.

However, that doesn’t negate the fact that it’s performance on unit shipments was among the worst compared with U.S. auto manufacturers (Table 1). The delayed shipments of 325,000 vehicles was somewhat responsible for the overall decrease (Table 2), and but it remains to be seen whether the company’s broadcasted transition to EVs will impede shipments further in 2022.

Ford’s stock price has countered the drop in U.S. auto sales, corresponding to the financial metrics in Table 3 .

Ford

Clearly, car manufacturers are hamstrung into transitioning to EV cars. It’s called green. Government regulations are forcing carmakers to scramble to meet strict emissions targets in Europe, China, and the U.S. led by California with its zero-emissions mandate.

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand