Insiders who acquired CN¥160m value of Geely Car Holdings Limited’s (HKG:175) inventory at an typical buy rate of CN¥20.69 about the final 12 months may be dissatisfied by the latest 8.7{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} lower in the inventory. Insiders obtain with the hope of viewing their investments boost in benefit around time. However, because of to new losses, their preliminary financial investment is now only worth CN¥151m, which is not wonderful.

Though we really don’t believe shareholders really should basically adhere to insider transactions, we do assume it is properly sensible to preserve tabs on what insiders are accomplishing.

Test out our most current assessment for Geely Vehicle Holdings

The Past 12 Months Of Insider Transactions At Geely Vehicle Holdings

The Govt Vice Chairman Donghui Li made the largest insider invest in in the previous 12 months. That solitary transaction was for HK$50m really worth of shares at a rate of HK$20.68 each. So it can be obvious an insider needed to buy, even at a increased cost than the present share price (currently being HK$19.44). When their see may perhaps have adjusted due to the fact the order was created, this does at least recommend they have experienced self esteem in the firm’s potential. In our see, the value an insider pays for shares is incredibly vital. It is generally a lot more encouraging if they paid above the existing value, as it suggests they saw value, even at higher concentrations.

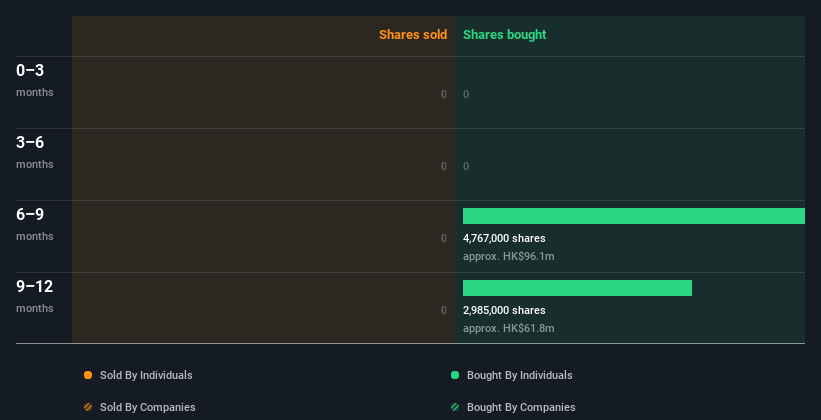

Although Geely Vehicle Holdings insiders bought shares all through the final year, they failed to promote. The chart under shows insider transactions (by organizations and individuals) above the previous year. If you click on the chart, you can see all the specific transactions, which include the share rate, unique, and the date!

Geely Auto Holdings is not the only inventory that insiders are obtaining. For these who like to find successful investments this totally free record of rising businesses with modern insider purchasing, could be just the ticket.

Insider Possession of Geely Car Holdings

Searching at the full insider shareholdings in a organization can help to advise your watch of no matter whether they are nicely aligned with common shareholders. I reckon it truly is a superior indication if insiders personal a sizeable amount of shares in the firm. Geely Auto Holdings insiders very own 2.6{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of the organization, at this time value about HK$5.0b centered on the latest share cost. This kind of substantial possession by insiders does normally enhance the possibility that the enterprise is operate in the curiosity of all shareholders.

What Could possibly The Insider Transactions At Geely Car Holdings Explain to Us?

There have not been any insider transactions in the very last a few months — that would not imply a lot. But insiders have revealed a lot more of an urge for food for the inventory, around the very last 12 months. With superior insider possession and encouraging transactions, it seems like Geely Automobile Holdings insiders consider the enterprise has advantage. So although it is handy to know what insiders are executing in terms of shopping for or marketing, it can be also practical to know the threats that a unique business is experiencing. To help with this, we have discovered 2 warning signs that you should run your eye above to get a much better photograph of Geely Automobile Holdings.

Of study course Geely Automobile Holdings may perhaps not be the most effective stock to purchase. So you may would like to see this totally free selection of substantial good quality organizations.

For the purposes of this write-up, insiders are all those individuals who report their transactions to the applicable regulatory body. We currently account for open market transactions and non-public inclinations, but not derivative transactions.

Have responses on this article? Involved about the information? Get in touch with us right. Alternatively, e mail editorial-staff (at) simplywallst.com.

This short article by Just Wall St is general in mother nature. We give commentary based on historic data and analyst forecasts only working with an unbiased methodology and our articles or blog posts are not supposed to be fiscal guidance. It does not represent a advice to buy or provide any inventory, and does not choose account of your targets, or your monetary condition. We intention to carry you prolonged-expression focused investigation pushed by essential info. Take note that our examination might not factor in the most up-to-date cost-delicate company bulletins or qualitative materials. Simply Wall St has no situation in any shares pointed out.

More Stories

Tips for Negotiating the Best Deal When Selling Your Car

5 Women That Shaped the Automobile and the World Around It (and Us)

Automobile retail sales see double-digit growth in February on robust demand