Allison Transmission Holdings Inc. (ALSN, Monetary) is a designer and maker of very engineered auto propulsion solutions for industrial and protection autos. It’s the world’s biggest manufacturer of medium- and significant-responsibility entirely automatic transmissions. It is increasingly shifting into electrified car propulsion options.

It was previosly aspect of General Motors Co. (GM, Money) prior to getting marketed to private equity companies The Carlyle Team and Onex Corp. in a offer valued at $5.6 billion in 2007. On March 15, 2012, its first public presenting of 26.3 million shares was priced at $23 for every share on the New York Stock Exchange.

With a 100-year operating background and a report of accomplishment in innovation, Allison Transmission is the world-wide chief in the marketplaces it serves with a leading totally automated transmission manufacturer and as an proven provider of entirely integrated electrified propulsion devices. It has a sound fiscal posture with an field-leading working margin and important absolutely free money flow generation. Allison has a history of returning cash to shareholders via buybacks and dividends.

The following chart shows Allison’s web gross sales breakdown by end industry.

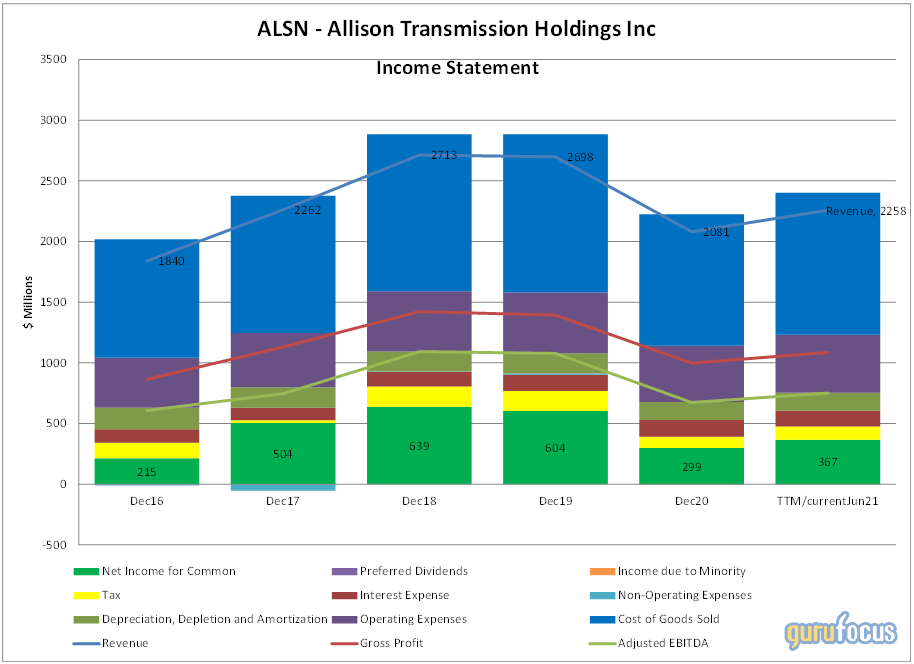

Allison’s revenue, which was rising till it took a hit in 2020, is recovering and so is its profits. The corporation is cyclical, so earnings is really a lot tied to the economic climate and truck production.

Operating margins are healthy at more than 25{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91}. The problem now is, of system, no matter whether these margins are sustainable as the shift to electric autos accelerates for heavier autos.

Allison begun off its independent life with all around $2.8 billion in extensive-term personal debt. On the other hand, it has purchased back a large amount of its stock over time. As the chart underneath shows, diluted shares have lessened from 186 million to around 109 million since 2012. This is a constant buyback rate of 6.8{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} a calendar year. In addition, the dividend yield of 2.1{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} is also expanding. In general, this is an great shareholder return.

Pursuing is a snapshot of Allison’s balance sheet. A few of items standout, together with its significant stage of long-term financial debt and large intangible belongings. (These merchandise are a legacy of the company’s time with private equity. Its element of private fairness leveraged buyout playbook to buy undervalued assets, load the company with credit card debt, extract fairness and carry the enterprise again into public market place at an opportune time.)

Allison’s financial debt maturity profile is distribute out, but with plenty of liquidity it’s not a little something to be concerned considerably about. Ebitda is comfortably additional than 4.5 times of fascination on debt.

Summary

Allison is at present selling at a price-earnings ratio of 9.33, which is arguably very reduced for a enterprise expanding sales and earnings at a double-digit rate over the previous five yrs.

Hunting at the pursuing chart, which demonstrates the stock’s valuation based on its median price tag-earnings, price tag-product sales, rate-e book and price-to-working money movement, I feel the stock selling price should really be in the mid-$40 assortment. Value Line’s projections set it at a $50 for each share concentrate on in 18 months and the a few to 5-year assortment in the $60 to $70 band. This is dependable with my assessment.

t.

t.

Insider action is neutral. An examination of modern insider action indicates insider shopping for when the inventory in the $30s and selling when in the $40s. Based mostly on these developments, it seems to be an opportune time to get the inventory.

The marketplace is anticipating the coming electrification of trucks with all the buzz bordering Tesla’s (TSLA, Monetary) semi-trucks, Ford’s (F, Money) F-150 Lightning, Standard Motors’ Hummer as effectively as other startups like Nikola (NKLA, Economic) and Lordstown Motors (Experience, Economical), between many others. Investors are presently doubtful as to what diploma these new-fangled electric powered vehicles will require gears and transmissions and, if so, irrespective of whether these electric powered transmissions will require the intricate amount of engineering related with ICE auto, or if will they be easier affairs. Some vans, like the 1 from Lordstown Motors, really don’t even have an axle as the motors are in the hubs of the wheel. This uncertainty has overwhelmed down Allison’s stock, compressing its valuation, as expressed by the decreasing of the organization price/Ebitda ratio. However, the imagined that Allison will be still left adrift in the coming electrification of the truck market place is an oversimplification.

Electrification of the truck sector will commence slowly, providing Allison enough time to shift its merchandise vary to cater to hybrid and electric cars and fully new products traces. Allison is creating opportunistic tuck-in acquisitions to bolster its functionality in electrification. For case in point, Allison Transmission obtained Vantage Electricity and AxleTech’s electric auto systems division (fleetequipmentmag.com). In simple fact, it is really by now created much progress in this regard and has released new devices to cater to hybrid and totally electrical vehicles. About 8{7b5a5d0e414f5ae9befbbfe0565391237b22ed5a572478ce6579290fab1e7f91} of Allison’s income arrives from weighty defense motor vehicles like principal battle tanks and armoured staff carriers, which will likely be never electrified (think about making an attempt to obtain a charging outlet on a battlefield).

Allison’s return on equity and return on invested capital is exceptionally fantastic. Hence, absent a recession, I see no distinct purpose why the stock should really proceed to languish in the mid-$30s for extensive. It was buying and selling in the higher $40 range just before the Covid-19 pandemic and the firm’s earning electric power is in no way impaired. I imagine the stock sector is underestimating Allison and attributing a lower a number of to earnings centered on its placement as an automobile part supplier to the truck industry. However, I think Allison is a more of an asset-gentle, mental residence-centered company supplied it higher return on equity and return on invested cash.

More Stories

Toyota Automatic Transmission: Shifting Gears with Precision

8-Speed Transmission: Navigating the Road to Efficiency and Performance

Add Another One To The Stick Shift List — The 2023 Acura Integra Will Get A Manual Transmission!